Revolutionary Company Formation in IFZA Dubai

Choose IFZA for a quick and streamlined free zone business setup, ensuring efficiency and ease every step of the way.

The International Free Zone Authority (IFZA) in Dubai is a premier free zone offering an efficient and affordable business setup solution for entrepreneurs and companies from various industries. Originally established in 2018 in Fujairah, IFZA relocated in 2020 to Dubai Silicon Oasis, placing it strategically close to major business hubs in the city. This move has greatly enhanced its appeal, making it an ideal choice for a business setup in Dubai

One of the key advantages of IFZA company formation is its flexibility. Unlike other free zones that focus on specific industries, IFZA allows businesses from over 800 approved activities to operate within the zone. Whether you’re in trading, services, logistics, or manufacturing, company formation in IFZA Dubai provides a streamlined process for a range of business types, making it accessible to a diverse group of entrepreneurs.

IFZA has also gained a reputation for its cost-effective pricing. The license cost in IFZA is highly competitive, making it the most affordable free zone option in Dubai. This makes it an attractive destination for both local and international businesses looking to benefit from Dubai’s dynamic economy.

When considering the IFZA free zone license cost, businesses can rest assured they are receiving exceptional value for top-tier infrastructure and business support. In addition to the cost savings, the IFZA business setup cost remains one of the lowest in the market, making it an excellent choice for entrepreneurs looking to minimize initial setup costs. Overall, IFZA offers a versatile, investor-friendly environment that makes starting a business in Dubai quick, affordable, and efficient.

Company Formation in IFZA Dubai

Setting up a company in IFZA, Dubai is a quick and straightforward process. For a seamless and hassle-free experience, it’s advisable to work with a Registered Agent like Finmaas. Our expert team will provide comprehensive guidance and support throughout the company formation process and beyond.

We’ll assist you in selecting the most appropriate and affordable business package to realize your dream company in Dubai. IFZA is a popular choice among foreign investors for their startup businesses.

IFZA Free Zone offers a range of facilities, including offices, warehouses, residential apartments, hotels, and retail outlets. There are various license options available, such as Consultancy License, Service License, Trading License, General Trading License, Industrial License, and Holding License, to effectively cater to the needs of both small local businesses and large international enterprises.

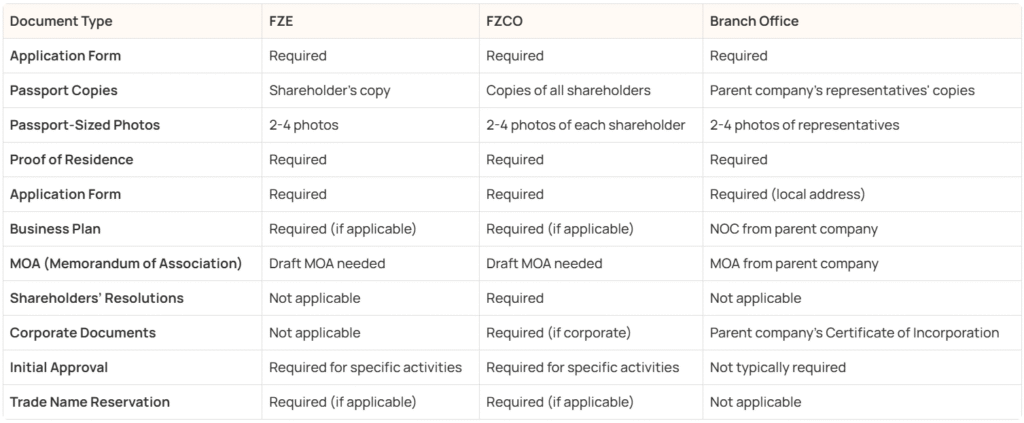

Documents Required in IFZA

Licenses Available in IFZA

- E-commerce License

- Food & Beverages Trading License

- General Trading

- Events Management License

- Tourism License

- Human Resources Consultancy License

- Travel Agency License

- Auto Spares & Components Trading License

- Management Consultancy License

- Accounting License

- Corporate Services Provider License

- Computer Trading License

- Immigration Services License

- Home Furniture Trading License

- Green Buildings Consultant License

- Construction & Building Materials Trading License

- IT Consultancy License

- Tyres & Accessories Trading License

- Advertising & Marketing License

- Real Estate License

FAQ’S

Can a mainland company do business in a free zone?

Is a free zone tax-free?

What are the benefits of a Free Zone visa?

Ability to operate in a tax-exempt environment, meaning companies will not pay corporate or income taxes on their profits.

Facilitates easier reinvestment of earnings for quicker growth.

Simplified business setup process with various incentives provided by the free zones.

Can a Free Zone company conduct business on the mainland?

Ability to operate in a tax-exempt environment, meaning companies will not pay corporate or income taxes on their profits.

Facilitates easier reinvestment of earnings for quicker growth.

Simplified business setup process with various incentives provided by the free zones.

Can a Freezone company have an office in Dubai?

How to start a business in Dubai Free Zone?

Choose a business activity and type of license.

Select the appropriate Free Zone based on your business needs.

Choose the right legal structure and licensing for your company.

Pick a business name and register with the Free Zone Authority.

Prepare the required legal documents.

Submit your company license application to the Free Zone Authority.

Pay the applicable fees and meet the capital requirements.