Open Your Personal Bank Account in Dubai with Ease and Confidence

Let Finmaas handle the entire process for you, from documentation to approvals, ensuring a smooth and hassle-free experience. We’re here to help you every step of the way!

Personal Bank Account in Dubai

One of the first essential steps after settling in Dubai is opening a personal bank account. Whether you’re a resident or new to the city, having a reliable bank account is crucial for managing your finances smoothly. However, navigating the banking system in a foreign country like the UAE can be challenging.

Dubai’s banking sector is governed by the UAE Central Bank, which has implemented stringent compliance procedures to ensure security and transparency. For many, the process of opening a personal bank account can seem complex, especially when dealing with unfamiliar regulations.

Here’s where Finmaas steps in

Our team of banking experts is here to guide you through the entire process, making it seamless and hassle-free. We understand the intricacies of UAE banking regulations and have the expertise to ensure your account setup is smooth and efficient.

Private Banking Options available in Dubai

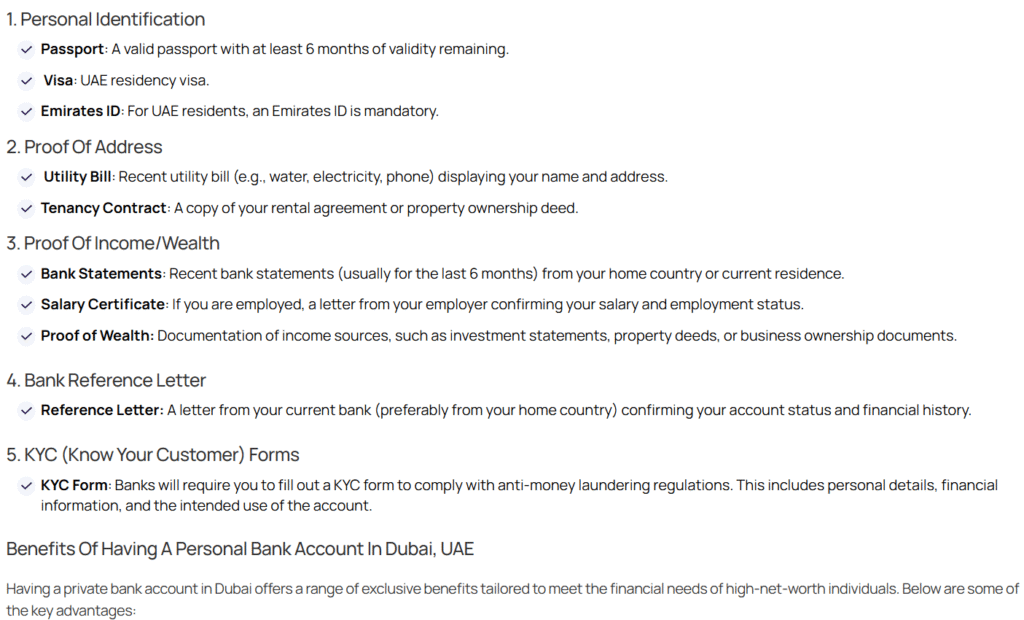

Documents required to open Private bank account in Dubai

Opening a private bank account in Dubai requires specific documentation to comply with the UAE’s banking regulations. Below is a list of common documents typically needed

Benefits of having a Personal Bank Account in Dubai, UAE

Having a private bank account in Dubai offers a range of exclusive benefits tailored to meet the financial needs of high-net-worth individuals. Below are some of the key advantages

01. Exclusive Investment Opportunities — Access to Premium Investments: Private banking clients often have access to exclusive investment opportunities, including private equity, hedge funds, and high-yield bonds, which are not available to the general public.

Global Investment Options: With a private bank account in Dubai, you can explore and invest in global markets, benefiting from a diverse portfolio.

02. Enhanced Privacy and Security — Confidentiality: Dubai’s private banking sector is known for its high level of confidentiality, ensuring that your financial information is securely protected.

Advanced Security Measures: Private banks in Dubai employ state-of-the-art security technologies and practices to safeguard your assets against fraud and unauthorized access.

03. High-Interest Rates and Preferential Terms — Competitive Interest Rates: Private bank accounts often come with higher interest rates on deposits, helping you grow your wealth more effectively.

Preferential Loan and Credit Terms: Clients enjoy favorable terms on loans, credit facilities, and mortgages, often with lower interest rates and flexible repayment options.

04. Global Banking Services — International Reach: Private banks in Dubai offer global banking services, including multicurrency accounts, international wire transfers, and access to a global network of ATMs.Seamless Currency Exchange: Enjoy competitive exchange rates and seamless currency conversion services, ideal for clients with international business dealings or travel needs.

05. VIP Lifestyle Benefits — Exclusive Perks and Rewards: Private banking clients often enjoy luxury lifestyle benefits, such as VIP access to events, concierge services, and exclusive offers on travel, dining, and leisure.

Premium Credit Cards: Access to exclusive credit cards with enhanced spending limits, cashback offers, and travel rewards tailored for high-net-worth individuals.

06. Tax Efficiency — Tax Optimization Strategies: Dubai’s private banks offer tax-efficient investment strategies and advice, helping you minimize your tax liabilities while maximizing returns.

Access to Offshore Accounts: Benefit from offshore banking solutions that offer potential tax advantages, depending on your residency and citizenship status.

These benefits make private banking in Dubai a highly attractive option for those seeking comprehensive and personalized financial management services in a secure and sophisticated environment.

Why Choose FInmaas for Your Personal Bank Account Setup in UAE?

Opening a personal bank account in Dubai doesn’t have to be overwhelming. Let finmaas take care of the complexities, so you can focus on enjoying your new life in the UAE.

Simplify Your Banking Experience with finmaas

FAQ’S

What are the general requirements to open a private bank account in Dubai?

Proof of Address: Utility bill, bank statement, or rental agreement.

Employment Details: Information about your employment status and income.

Tax Details: Relevant tax documentation based on your residency status.

Additional Documentation: Depending on the bank and your personal qualifications, additional documents may be required. This could include a letter of no objection from your employer, a salary certificate, or a reference letter.